A Silver lining in difficult times

- Korbinian Koller

- Dec 8, 2020

- 6 min read

2020 has been a challenging year. We ache for some peace and comfort. Christmas is right before the door, but that can be a challenge as well. Trips to the mall are not without risk and for many, this year had its economic challenges as well. Why not in times like these preserve the wealth and instead of clothes that get out of fashion, toys one outgrows and gadgets that get outdated give the gift of silver coins. A Silver lining in difficult times.

We spoke all year of physical Silver accumulation and have caught cheap entry spots shared in real-time in our free Telegram channel. Two weeks ago we forecasted a temporary drop in the precious metal sector, which has manifested. In our opinion quite possibly the last cheap entry point for the physical accumulation of the valuable commodity, that could provide more for your family than just a temporary joy. A gift that will be remembered that you had the foresight for a necessary transition from an unstable fiat currency to a wealth preserving gift that keeps giving for years to come in value appreciation.

The above might sound like a cheap sales commercial but we are not sellers, we don’t profit from your choice to buy Silver, we truly believe in the value of Silver and give this gift to our own families this year.

Silver, Monthly Chart, Why so bullish?

Silver in US Dollar, monthly chart as of December 3rd, 2020

What makes us so bullish over the long run? Examining the monthly chart above, you will find a seasonal pattern over the last eight years that held steady even in our non-typical year 2020. Prices each year in November declined like clockwork (+preceding months). More importantly, are the numbers from these November lows to February highs (marked in yellow). This edge allows for the long term market participant an entry edge to reduce risk. Paired with our quad exit strategy it is a way to “get in” and eliminate risk by taking partial profits in this “odds stacked” three-month period.

Averaging the prior advances we get a percentage of +13.81%. Projecting this onto this year’s November lows a target of US$24.91 results as an initial thrust probability for a longer-term trade. Let us add an important fact that all prior percentages were calculated Silver trading in a sideways range. As such this year’s projection can be much higher because Silver is now in an uptrend.

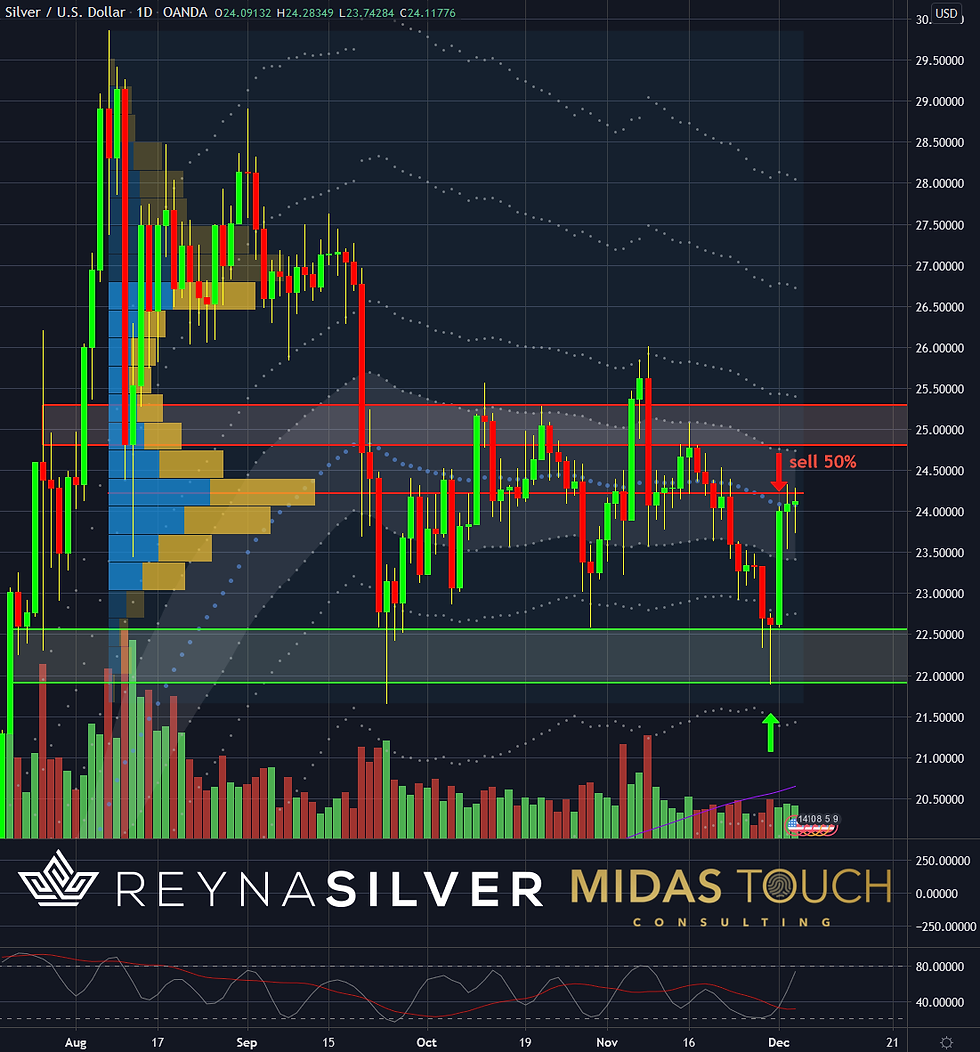

Silver, Daily Chart, Planned and executed like clockwork:

Silver in US Dollar, daily chart as of December 4th, 2020

Besides reloading our physical holdings, we also initiated based on the prior chart edge, among others, a larger turning point trade on November 30th. As usual, we posted this entry in real-time on our free Telegram channel. We expected this day to print November lows. We also anticipated this move already two weeks prior as stated in the weekly chartbook at that time.

As the prior monthly chart shows, there were occasions when December still brought lower lows. For the shorter term player, this is meaningful. From a daily position trade perspective (see daily chart above), one could get stopped out with the rest position and reentry would be required. As of now partial profits assure a profitable trade with a stop at break even entry levels. Prices sit right at a meaningful Volume analysis spot (POC) (red horizontal line). We are also trading at the mean (blue dotted line, which allows expansion of price in either direction). As such the market is waiting for a news item to find its next short-term directional move.

Silver, Weekly Chart, No one knows the future:

Silver in US Dollar, weekly chart as of December 3rd, 2020

Even though, no one knows the future and we do not have a crystal ball either, one can stack the odds in one’s favor. This trade shows that this doesn’t have to be elusive but merely requires exploiting stacked odds with discipline. The weekly chart shows a healthy, mild retracement after a steep trend up. With our entry price of US$21.93 on November 30th, we already had an advancing move by nearly ten percent. We financed this trade based on our quad exit philosophy and as such are now in a risk-free, profitable position with the remainder position size.

Probability points toward a likelier possibility to reach the other side of the sideways range and possibly beyond. Large time frame analysis creates a picture for Silver shining for many years to come.

A Silver lining in difficult times

Typically, Christmas is a huge expense. Giving the gift of Silver, you also comfort yourself since you preserve family wealth. Our recommendation isn’t based on nostalgia or otherwise romantic sentiment. We believe that price levels of Silver trading near US$24 right now are for many years to come a low level. We believe that physical acquisition here is a true bargain. One could speculate this precious metal heading towards three-digit numbers.

Join our free Telegram Group :https://t.me/joinchat/HGe22hDDEEl0LvFGAgEZ9g

All published information represents the opinion and analysis of Mr Korbinian Koller & his partners, based on data available to him, at the time of writing. Mr. Koller’s opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Koller is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations. As trading and investing in any financial markets may involve serious risk of loss, Mr. Koller recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Although a qualified and experienced stock market analyst, Korbinian Koller is not a Registered Securities Advisor. Therefore Mr. Koller’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. Past results are not necessarily indicative of future results. The passing on and reproduction of this report, analysis or information within the membership area is only legal with a written permission of the author.

Important Trading Risks and Earnings Disclaimers - Terms of Use

RISK DISCLAIMER: All forms of trading carry a high level of risk so you should only speculate with money you can afford to lose. You can lose more than your initial deposit and stake. Please ensure your chosen method matches your investment objectives, familiarize yourself with the risks involved and if necessary seek independent advice.

U.S. Government Required Disclaimer - Commodity Futures Trading Commission. Trading financial instruments of any kind including options, futures and securities have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options, futures and stock markets. Don't trade with money you can't afford to lose.

NFA and CTFC Required Disclaimers: Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of experience and risk appetite. Do not invest money you cannot afford to lose.

EARNINGS DISCLAIMER: EVERY EFFORT HAS BEEN MADE TO ACCURATELY REPRESENT THIS PRODUCT AND ITS POTENTIAL. THERE IS NO GUARANTEE THAT YOU WILL EARN ANY MONEY USING THE TECHNIQUES, IDEAS OR PRODUCTS PRESENTED. EXAMPLES PRESENTED ARE NOT TO BE INTERPRETED AS A PROMISE OR GUARANTEE OF EARNINGS.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAN ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All information presented or any product purchased from this website is for educational and research purposes only and is not intended to provide financial advice. Any statement about profits or income, expressed or implied, does not represent a guarantee. This presentation is neither a solicitation nor an offer to Buy/Sell options, futures stocks or securities. No representation is being made that any information you receive will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. Please use common sense. Get the advice of a competent financial advisor before investing your money in any financial instrument.

Terms of Use: Your use of this educational website indicates your acceptance of these disclaimers. In addition, you agree to hold harmless the publisher and instructors personally and collectively for any losses of capital, if any, that may result from the use of the information. In other words, you must make your own decisions, be responsible for your own decisions and trade at your own risk.

Comments