Silver leading Gold

- Korbinian Koller

- Apr 9, 2021

- 6 min read

Having isolated Silver, Gold, and Bitcoin as the most reliable wealth preservation vehicles for a looming hyperinflation scenario, we consistently look for each of these three instruments’ advantages and disadvantages over their counterparties. One abnormality stands out, which lets us to believe that Silver might be outperforming Gold and providing for extra bang for your buck. Silver leading Gold.

We are not after maximizing profits when talking about wealth preservation where risk is the dominant factor of focus. Nevertheless, it might be fundamental reasons why Silver is gaining this momentum for this newly found abnormality in relative strength behavior that warrants stacking up on more physical holdings. And no one will be disappointed if wealth isn’t just preserved and stored properly but also see some potential massive gains as well.

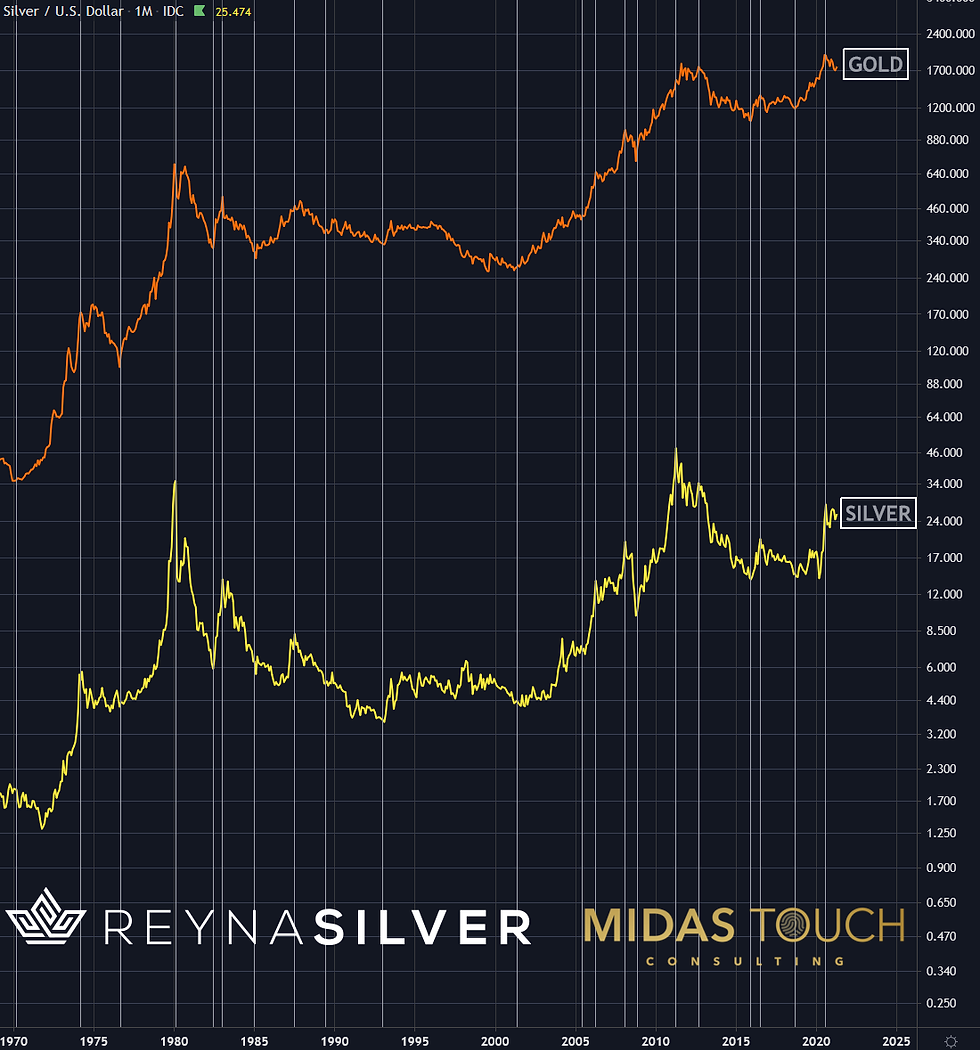

Silver and Gold in US-Dollar, Monthly Chart, Smooth alignment:

Silver and Gold in US-Dollar, monthly chart as of April 8th, 2021.

If you follow the vertical lines along with over the last fifty years on the monthly chart above with the comparison of highs and lows in the Silver markets compared to the Gold market, you will find great alignment. Both metals have been for thousands of years a good store of value in coins, bars, and jewelry.

Silver and Gold in US-Dollar, Weekly Chart, Silver gaining momentum over Gold:

Silver and Gold in US-Dollar, weekly chart as of April 8th, 2021.

Zooming in on last year’s Gold and Silver behavior on a weekly percentage chart shows a divergence in this comparison of the precious metals. While highs and lows from last year’s March to August were still in unison, something changed beginning in November 2020. Silver is clearly showing strength over Gold.

The fundamental reasons supporting this strength can only be speculated on. The fact is that Silver is in high demand for solar cells, 5G cellular technology, electric vehicles, Semi-conductors, photography, anti-bacterial, and medicines, to only name a few.

Daily Chart, Silver in US-Dollar, Clearly directional:

Silver in US-Dollar, daily chart as of April 8th, 2021.

A glance at the daily chart of Silver over the last year, we can clearly identify through a linear regression channel that Silver is in directional motion. This provides a high probability of the continuation of these price advancements. We find physical ownership to be the preferred method to hedge your wealth against a monetary debasement.

Silver in US-Dollar, Daily Chart, Multiple long entries with support:

Silver in US-Dollar, daily chart as of April 8th, 2021.

Let us now zoom further in on the daily chart of Silver over the last seven months. One can see that direction is also evident in the recent period of an overall sideways zone for Silver. A string of higher lows made us aggressively take entries within the last eight trading sessions. We use a Quad exit strategy and, as such, took partial profits already to eliminate risk. All trade entries and exits were posted in real-time in our free Telegram channel. The last bottom on Silver is now confirmed. Strong support at US$24.25 and US$25.18 based on transaction volume analysis is present. We find this to be a solid point in time to add to physical Silver holdings.

Let the gap between the spot price and the actual physical acquisition price not discourage you. This gap has been persistent for twelve months already. This is only another confirmation of how much the metal is sought after.

Silver leading Gold:

It is hard to say why Silver is coming so much to the forefront. Two facts are very attractive in our mind. One is divisibility. A Gold coin, if advancing vastly, will be a hard item to barter with since the smallest units are still very expensive. Gold as such is impracticable for making smaller size purchases. Silver is priced much lower. Secondly, Gold has a history of confiscation from private hands in turmoiled times. The likelihood of Silver being declared illegal is much lower due to its various daily applications. Should, as we expect, Silver outperform Gold in this bull market, you might just find yourself in a scenario of “have your cake and eat it too.”

Join our free Telegram Group :https://t.me/joinchat/HGe22hDDEEl0LvFGAgEZ9g

All published information represents the opinion and analysis of Mr Korbinian Koller & his partners, based on data available to him, at the time of writing. Mr. Koller’s opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Koller is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations. As trading and investing in any financial markets may involve serious risk of loss, Mr. Koller recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Although a qualified and experienced stock market analyst, Korbinian Koller is not a Registered Securities Advisor. Therefore Mr. Koller’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. Past results are not necessarily indicative of future results. The passing on and reproduction of this report, analysis or information within the membership area is only legal with a written permission of the author.

Important Trading Risks and Earnings Disclaimers - Terms of Use

RISK DISCLAIMER: All forms of trading carry a high level of risk so you should only speculate with money you can afford to lose. You can lose more than your initial deposit and stake. Please ensure your chosen method matches your investment objectives, familiarize yourself with the risks involved and if necessary seek independent advice.

U.S. Government Required Disclaimer - Commodity Futures Trading Commission. Trading financial instruments of any kind including options, futures and securities have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options, futures and stock markets. Don't trade with money you can't afford to lose.

NFA and CTFC Required Disclaimers: Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of experience and risk appetite. Do not invest money you cannot afford to lose.

EARNINGS DISCLAIMER: EVERY EFFORT HAS BEEN MADE TO ACCURATELY REPRESENT THIS PRODUCT AND ITS POTENTIAL. THERE IS NO GUARANTEE THAT YOU WILL EARN ANY MONEY USING THE TECHNIQUES, IDEAS OR PRODUCTS PRESENTED. EXAMPLES PRESENTED ARE NOT TO BE INTERPRETED AS A PROMISE OR GUARANTEE OF EARNINGS.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAN ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All information presented or any product purchased from this website is for educational and research purposes only and is not intended to provide financial advice. Any statement about profits or income, expressed or implied, does not represent a guarantee. This presentation is neither a solicitation nor an offer to Buy/Sell options, futures stocks or securities. No representation is being made that any information you receive will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. Please use common sense. Get the advice of a competent financial advisor before investing your money in any financial instrument.

Terms of Use: Your use of this educational website indicates your acceptance of these disclaimers. In addition, you agree to hold harmless the publisher and instructors personally and collectively for any losses of capital, if any, that may result from the use of the information. In other words, you must make your own decisions, be responsible for your own decisions and trade at your own risk.

Comments